Table of Content

You may still qualify for a loan even in your situation doesn’t match our assumptions. To get more accurate and personalized results, please call to talk to one of our mortgage experts. Based on the purchase/refinance of a primary residence with no cash out at closing. Keep in mind, though, some lenders may not allow you to use a dependent’s occupancy in order to meet the requirements.

Keep in mind, however, that the VA does not usually allow occupancy delays of more than 12 months.

Can I Work With a 100% Military Disability Rating?

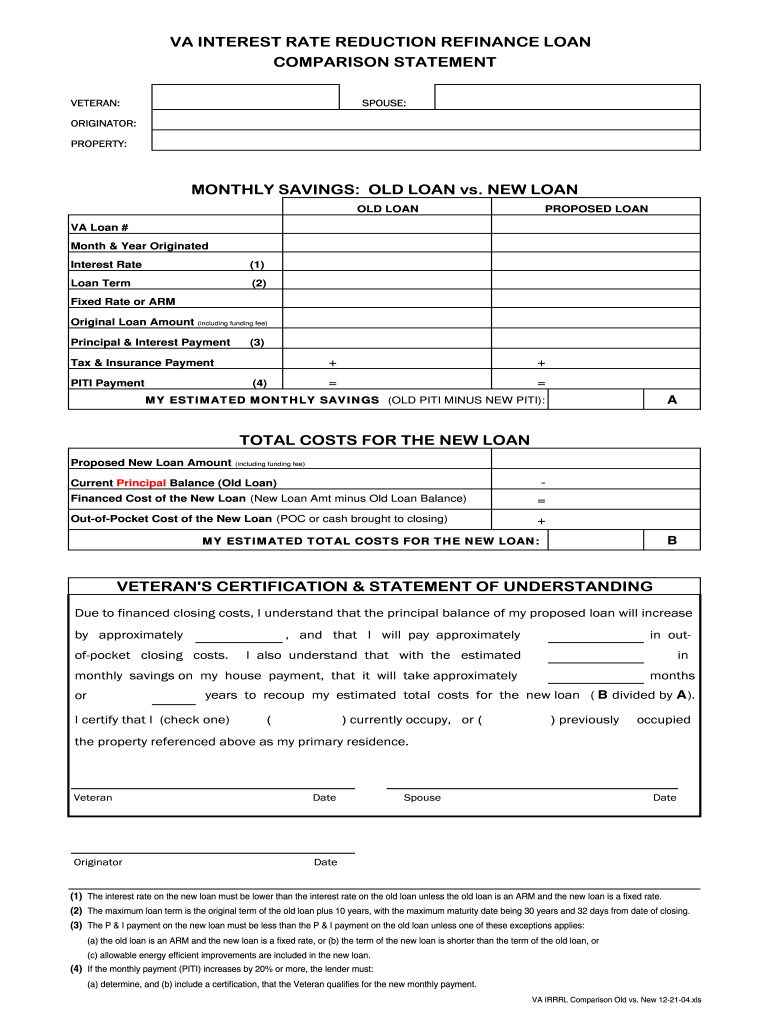

The VA Interest Rate Reduction Refinance Loan, also known as a VA Streamline Refinance, requires less effort. This type of loan only requires the borrower to certify that the home was their primary residence during the first mortgage. You must have satisfactory credit, sufficient income, and a valid Certificate of Eligibility to be eligible for a VA-guaranteed home loan. The eligibility requirements to obtain a COE are listed below for Servicemembers and Veterans, spouses, and other eligible beneficiaries. Learn about VA home loan eligibility requirements for a VA direct or VA-backed loan. Find out how to request a Certificate of Eligibility to show your lender that you qualify based on your service history and duty status.

Visitors with questions regarding our licensing may visit the Nationwide Mortgage Licensing System & Directory for more information. Actual payments will vary based on your individual situation and current rates. The VA requires the borrower to certify their intent to occupy on two documents. For example, a veteran who buys a home with a VA loan and then gets transferred overseas can rent out the home and still refinance that existing mortgage based on prior occupancy.

Delayed occupancy

But the issue of occupancy is important, not to mention often confusing, especially for first-time home buyers. There must be no indication that the Veteran has established, intends to establish, or may be required to establish, a principal residence elsewhere. This two-month moving window is "reasonable time," according to the VA.

For this to happen, a careful evaluation of the veterans’ income will be necessary, as will a specific date of retirement within the next 12 months. Without exception, servicemembers who are deployed from their duty station are allowed to purchase a property in their place of permanent residence. This is because they are considered to be in temporary duty, and their place of permanent residence remains constant during this. If you’ve made arrangements with your lender to fix or improve a home in order to meet MPRs, the VA allows you to occupy the home after the repairs have been made.

VA Home Loan

Your length of service or service commitment, duty status and character of service determine your eligibility for specific home loan benefits. You will have to meet the financial requirements to ensure you can afford both homes, even if you are receiving rental income from your previous property. There is no set required time for occupancy, but the paperwork will state that the borrower must live in the residence for at least 12 months.

You must certify that you intend to occupy the property as your home. Second homes and investment properties do not qualify for a VA loan. While it can seem daunting, understanding the occupancy requirements of a VA loan is actually quite simple if you break it down. VA loan rules leave room for occupancy requirement exceptions, including deployments and other types of military duty. Civilian ex-spouses can keep the home secured by a VA loan after a divorce as long as they assume the VA loan or refinance to another loan type.

How long do you have to occupy a home purchased with a VA loan?

You may be able to get a COE if you’re the surviving spouse of a Veteran or the spouse of a Veteran who’s missing in action or being held as a prisoner of war . Before sharing sensitive information, make sure you're on a federal government site. In addition to being a contributing writer at Rocket Homes, she writes for solo entrepreneurs as well as for Fortune 500 companies. When she isn’t helping people understand their finances, you may find Ashley cage diving with great whites or on safari in South Africa. Some jumbo products may not be available to first time home buyers. If the veteran intends to retire within the next 12 months and plans to move into the home, this can be approved.

However, if there is a cause to question occupancy, it is up to the lender to determine if the VA occupancy rule is fulfilled. First, the property you purchase with the VA loan must be a primary residence. Secondary homes and any other investment properties don’t qualify for a VA home loan. Also, you must move into the new home within a reasonable time frame, typically within 60 days of closing on the house. The VA allows for a spouse to fulfill the occupancy requirement for an active duty military member who is deployed or who cannot otherwise live at the property within a reasonable time. Veterans and active duty personnel who secure a VA loan have to certify that they intend to personally occupy the property as a primary residence.

In addition, service members need to make clear the specific date occupancy will occur and the specific event that will make occupancy possible. For Interest Rate Reduction Refinancing Loans , or VA Streamline loans, the Veteran need only certify that they previously occupied the property as their home. A VA Cash-Out refinance will require the borrower to certify occupancy to be eligible for refinancing. In instances where your job keeps you from home for extended periods, the VA is fairly flexible. You don't need to be at your house every day to satisfy occupancy requirements, but you are expected to be there for a reasonable amount of time.

There are no VA police going door to door verifying the occupancy rule was met, although rare a lender can order an occupancy check if they want to. We've created these handy tools to help guide you through the VA loan process. Get the best deal on a VA home loan comparing the Nation's most trusted lenders side-by-side.

In many cases, assuming the existing VA loan is beneficial because VA loans often come with lower interest rates and lower fees than other loan types. After one year of occupying the home you can plan to rent your property and hold it now as an investment property. You cannot use VA financing for investment properties or second homes. However, after living in the property for the required amount of time, you can use the home as you see fit and rent it out or sell.

This requirement is met regardless of whether or not your spouse will be occupying the property while you’re deployed. The key when it comes to occupancy is clear communication with your lender and your loan specialist. The VA and lenders share the same goal — helping veterans become homeowners.

Do VA loan occupancy requirements apply for refinance loans?

Not having your full VA entitlement would limit your $0 down purchase power. Your ex is removed from the loan and the property’s title during the refinance, meaning they no longer have any responsibility or claim to the property, and you will now be the sole owner. If there are no suspicious circumstances, it is up to the lender to determine occupancy.

According to the VA official site, the lender must decide if “a reasonable basis exists for concluding that the veteran can and will occupy the property as certified. There are other reasons why a borrower may not be able to move into a home purchased with a VA mortgage right away. If the home is being repaired, renovated, or remodeled in conjunction with a VA mortgage loan, the home may not be habitable at closing time. If you plan on retiring within 12 months after applying for your VA loan, you might be able to negotiate for a later move-in date. A retiring veteran must include a copy of their application for retirement, and VA lenders will carefully consider if the retiree’s income is sufficient to maintain a home loan. For married active-duty service members, a spouse can fill the occupancy requirement.

No comments:

Post a Comment